Boart Longyear Announces 2013 Full Year Financial Results, Amendment to Credit Agreement and Review of Strategic Options

Boart Longyear Limited (ASX: BLY), the world’s leading supplier of drilling services, drilling equipment and performance tooling for mining and drilling companies, today announces its financial results for the full-year ended 31 December 2013 and a further amendment to the covenants of its US$140 million revolving credit agreement (“Credit Agreement”). In addition, the Company is providing updates on its operations, including key performance indicators and an outlook for expected market conditions in 2014.

2013 full year results:

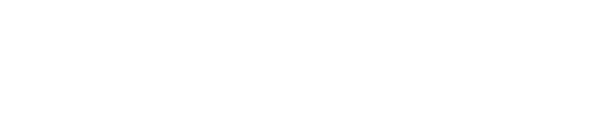

- Revenue of US$1,223 million, compared to US$2,012 million in 2012

- Statutory EBITDA of (US$337 million loss) compared to earnings of US$254 million in 2012

- Adjusted1 EBITDA of US$107 million compared to US$322 million in 2012

- Statutory net loss after taxes (NPAT) of (US$620 million) compared to US$68 million net profit in 2012

- Adjusted1 NPAT of (US$94 million loss) compared to US$116 million profit in 2012

- Statutory losses per share of (US$1.36) compared to an earnings per share US$0.15 in 2012

- US$461 million of restructuring charges and asset impairments (of which US$421 million were non-cash) taken as a result of continuing weakness in core markets

Summary:

- US$107 million adjusted EBITDA on 39% lower revenue

- US$115M of cost reductions realised in 2013 and an additional US$58M projected in 2014

- Net Debt remained relatively flat, despite declining market conditions and revenues

- Six new products launched, with more projected to launch in 2014

- Covenant compliant at 31 December 2013

- Amendment to Credit Agreement completed 22 February 2014

- Review of strategic options to achieve a sustainable capital structure initiated.

Financial Overview

In spite of 2013 being an extremely challenging year for the global mining industry and the Company’s core markets, the Company generated US$107 million of adjusted EBITDA and held net debt relatively flat. With a backdrop of declining prices and a weak outlook for most key commodities, increased political and economic risk for mining activity and a focus on maximising near-term cash flows, many of the world’s mining companies significantly reduced their exploration, development and capital expenditures during the year. As a result, the Company experienced a material reduction in demand for its drilling services and products that impacted revenue and other key financial measures, as set out in the table below:

Additional analysis of the Company’s 2013 financial performance and results is available in the Operating and Financial Review of the Company’s preliminary annual financial report for 2013.

Operational Overview

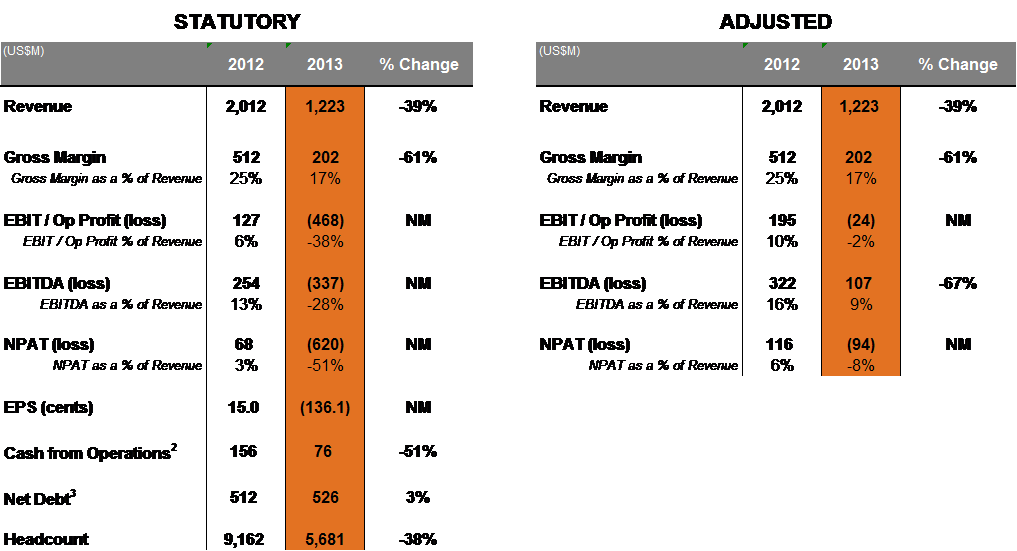

The Company’s operating drill rig utilisation averaged approximately 40% during 2013, with a more significant decline experienced during the second half of the year. Going forward, the Company will report its utilisation metric using only operating rigs in order to better reflect current operating conditions. The Company has, prior to this release, calculated drill rig utilisation as the sum of the weekly average of operating rigs plus the number of rigs assigned (but not yet drilling) to a contract divided by total rigs in the fleet.

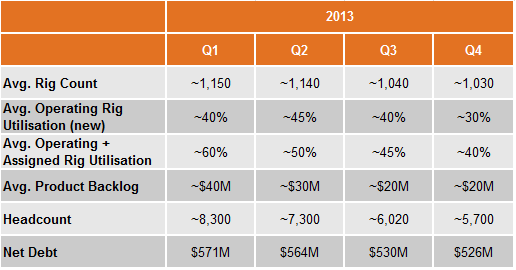

While the division won key contracts in Chile, Saudi Arabia and the Democratic Republic of Congo, overall demand for surface coring drilling was slow. Demand for underground drilling remained strong throughout the year and mine water drilling services continued to gain traction.

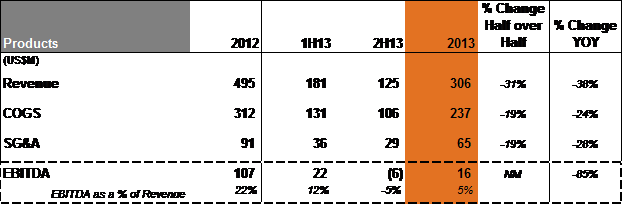

Revenue and EBITDA for the Products division declined through the year until stabilising in the second half of 2013 (apart from the typical seasonal decline the business experiences around the holiday period). Revenue in the first half of 2013 was US$181 million compared to US$125 million in the second half. EBITDA in the first half was US$22 million compared to a loss of US$6 million in the second half. Adjusted for non-cash charges associated with the Company’s policy for slow-moving inventory, EBITDA in the first half was US$32 million compared to US$7 million in the second half. EBITDA margins were impacted by slightly lower pricing in 2013 compared to 2012 and higher fixed cost deleveraging related to the Company’s manufacturing plants, which were largely idle or at much-reduced utilisation levels.

Investments continued in new product development, which resulted in six new products being launched in 2013, and ongoing new product development activity has focused on production tooling and equipment and incremental enhancements to existing products to drive safety and productivity.

The Products division’s results were impacted by low rig utilisation rates among its customers, who continued to de-stock throughout the year and appear likely in 2014 to hold only minimal levels of inventory necessary to support their ongoing operations.

Credit Agreement Amendment

Based on the Company’s view that market conditions may not significantly recover over the next twelve months, the Company negotiated an amendment to its Credit Agreement that is intended to provide continued access to the revolving credit facility and additional head room under the Credit Agreement’s financial covenants. The amendment, which became effective on 22 February 2014, eliminates the Minimum Asset Coverage financial covenant and suspends the following financial covenants through the 31 March 2015 compliance testing date:

- Minimum Liquidity of US$30 million (tested monthly)

- Minimum Interest Coverage Ratio of 1.55x (tested quarterly)

New financial covenants have been added, which require:

- minimum cumulative last-twelve-months EBITDA of US$45 million through 31 March 2015 (tested quarterly); and

- maximum Total Debt5, at the levels set out below, to be tested quarterly through the maturity date of the Credit Agreement, which remains unchanged at 29 July 2016:

(i) US$700 million at 30 June 2014

(ii) US$700 million at 30 September 2014

(iii) US$670 million at 31 December 2014

(iv) US$720 million at 31 March 2015

(v) US$725 million at 30 June 2015 and for each quarterly testing date thereafter.

The specified maximum Total Debt5 levels may vary upon the occurrence of certain events. In addition, the amendment adjusts fees and pricing, introduces new financial reporting requirements, establishes a monthly borrowing base of specified assets to allowed borrowings, limits annual capital expenditures and requires the Company, by 30 September 2014, to present a plan to the banks that proposes full repayment of the facility by the maturity date, which will be subject to an independent review.

Material Uncertainty and Strategic Review of Options

As disclosed in the Company’s financial report, the Company’s full-year 2013 financial statements have been prepared on the basis of a going concern, subject to certain risks outlined in Note 2 of the financial report that give rise to a material uncertainty about the Company’s ability to meet its financial obligations as and when they come due. The Company contemplates the continuity of normal business activities and the realisation of assets and settlement of liabilities in the ordinary course of business and in their stated amounts. At 31 December 2013, the Company was in compliance with all covenants of its Credit Agreement and had access to nearly all of its US$140 million credit facility, other than US$10.4 million of letters of credit outstanding at that date.

The Company believes it will successfully manage its business and associated liquidity risks despite the weak and uncertain market environment via further operational enhancements, opportunities to reduce costs associated with potentially declining business conditions and other strategies for managing liquidity and accessing capital. The Company’s Board of Directors also has appointed Goldman Sachs as its advisor and initiated a strategic review to maximise value for Boart Longyear stakeholders, preserve the franchise value of both the Drilling Services and Products divisions, provide continuity of services and products to the Company’s global customer base, ensure capital adequacy to continue as a going concern and position the business to capture future growth when the market recovers. The Company does not intend to provide updates on the progress of the strategic review until it has material developments to report.

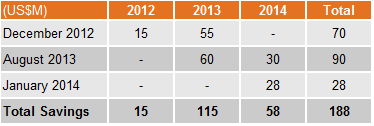

Cost Reduction Update

Management continues to pursue other efficiencies through longer-term structural improvements, and the benefit of those efficiencies is expected to be realised in future periods. The Company expects 2014 SG&A to be between US$165 million and US$170 million, compared to US$202 million and US$298 million reported for 2013 and 2012, respectively.e its overall fixed cost profile through the removal of certain SG&A and overhead expenses. Nearly US$190 million of total run-rate savings has been achieved through three cost reduction programmes, which were undertaken in December 2012, August 2013 and January 2014. The Company estimates the impacts of the programmes and the periods in which savings are realised to be as indicated in the table on the right.

Dividend

In light of current circumstances, the Board considers it appropriate not to declare a dividend for the period ended 31 December 2013. The Board will continue to evaluate the Company’s financial position and key performance indicators on a regular basis and intends to resume payment of dividends when conditions allow.

Key Performance Indicators

The Company reports the following key performance indicators, including the reduction in net debt achieved despite challenging conditions.

2014 Outlook

The Company is not providing a market outlook for 2014 revenue or EBITDA given current market uncertainty. It expects, however, that the primary factors driving its revenue, such as rig utilisation rates and product sales volumes, will remain broadly consistent with levels experienced in the fourth quarter of 2013. Profitability will be influenced by those and other factors, such as price, productivity and management’s ability to further control costs. The Company believes current market expectations for 2014 revenue and EBITDA, including even at the low end of 2014 analyst estimates compiled by Bloomberg of US$979 million in revenue and US$77 million in EBITDA, may not be based on the most current available market information regarding industry conditions.

Richard O’Brien, Boart Longyear’s President and Chief Executive Officer, commented on 2013 results, “2013 was difficult for the Company and its stakeholders. We have taken decisive and aggressive action throughout the year to confront and manage the challenges created by our markets and leverage. We will continue to focus on our current priorities of debt reduction, safety and compliance and serving our customers’ needs. We also will continue to pursue improvements to our capital structure as necessary to maximise value for all stakeholders.

“To that end, we have initiated a strategic review to ensure all options are considered carefully and completely, not only to meet today’s needs but to position the business to capitalise on future opportunities. Our markets will improve, and, when they do, we are much better positioned to deliver improved profit margins and cash generation through our cost efficiency measures, revised capital deployment strategies, increased speed to market, more customer-driven design and our combined platforms for supply chain, inventory management and maintenance services.

“While we cannot predict when our markets will recover, we have the experience of 120-plus years to know that mineral exploration spending will increase, as mining company reserves must be replenished to satisfy ongoing, worldwide commodity demand. Boart Longyear will continue to stand ready to serve existing and expanding markets for our Global Products and Drilling Services customers around the globe.”

Disclaimer

This announcement contains certain “forward-looking statements.” The words “anticipate, “believe”, “expect”, “project”, “forecast”, “estimate”, “likely”, “intend”, “should”, “could”, “may”, “target”, “plan” and other similar expressions are intended to identify forward-looking statements. Indications of, and guidance on, future earnings and financial position and performance are also forward-looking statements. Due care and attention has been used in the preparation of forecast information. Such forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors, many of which are beyond the Company’s control and may cause actual results to differ materially from those expressed or implied in such statements. There can be no assurance that actual outcomes will not differ materially from these statements.

About Boart Longyear

With over 120 years of expertise, Boart Longyear is the world’s leading provider of drilling services, drilling equipment, and performance tooling for mining and drilling companies globally. It also has a substantial presence in aftermarket parts and service, energy, mine de-watering, oil sands exploration, and production drilling.

The Global Drilling Services division operates in over 40 countries for a diverse mining customer base spanning a wide range of commodities, including copper, gold, nickel, zinc, uranium, and other metals and minerals. The Global Products division designs, manufactures and sells drilling equipment, performance tooling, and aftermarket parts and services to customers in over 100 countries.

Boart Longyear is headquartered in Salt Lake City, Utah, USA, and listed on the Australian Securities Exchange in Sydney, Australia. More information about Boart Longyear can be found at www.boartlongyear.com. To get Boart Longyear news direct, visit https://www.boartlongyear.com/rssfeed.

1Adjusted EBITDA, Adjusted EBIT, and Adjusted NPAT are non-IFRS measures and are used internally by management to assess the performance of the business and, for 2013, have been derived from the Company’s financial statements by adding back US$444 million pre-tax (US$526 million post-tax) comprising US$461 million of restructuring charges and impairments, offset by a pension related gain of US$17 million.

2 Before interest and tax payments

3 Excludes contingent liabilities relevant to determining bank covenant compliance. See footnote #31 in Financial Report.

4 Does not include restructuring and impairment charges

5 “Total Debt” means, as of any date, the Total Revolving Outstandings and any other Finance Debt of the Group outstanding (whether actually or contingently) on that date, but excluding (to the extent otherwise included): (i) contingent exposures under hedge or derivative transactions other than currency hedge or derivative transactions that hedge Finance Debt; (ii) Finance Debt owed by a Group member to another Group member; (iii) contingent liability under any letters of credit (other than those issued under this Agreement) which support performance obligations of a Group member, performance bonds or performance guaranties (or bank guaranties or letters of credit in lieu thereof) occurring within the ordinary course of business but not obligations in respect of Finance Debt; and (iv) to avoid double counting, contingent liability under any other letters of credit issued to secure external Finance Debt of a Group member to a financier to the extent such Finance Debt is already included in the calculation of the definition.