Boart Longyear Announces 2014 First Half Results and Update on Strategic Review

26 August 2014

Boart Longyear Limited (ASX: BLY), the world’s leading supplier of drilling services, drilling equipment and performance tooling for mining and drilling companies, today announces results for the half-year ended 30 June 2014. The reported results are in line with preliminary results announced on 28 July 2014.

The Company is also providing an update on the status of its ongoing strategic review of recapitalisation options and confirming current market estimates for full-year 2014 performance. Financial results are reported in US dollars.

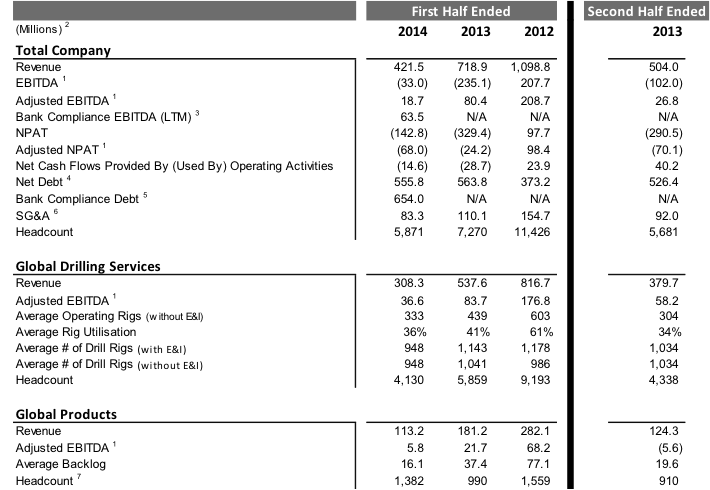

2014 first half financial results:

- Revenue of $422 million (1H 2013: $719 million)

- Statutory net loss after taxes of $143 million (1H 2013: $329 million loss)

- Adjusted1 net loss after taxes of $68 million (1H 2013: $24 million loss)

- Statutory EBITDA loss of $33 million (1H 2013: $235 million loss)

- Adjusted1 EBITDA of $19 million (1H 2013: $80 million)

- Statutory loss per share of $0.31 (1H 2013: $0.73 loss)

- $52 million of restructuring expenses and related impairments before tax (of which $43 million were non-cash)

- Available liquidity to sustain operations, with $68 million in cash as at 30 June 2014 and continuing access to bank revolver

Comparative information:

Business overview

The Company refers to its ASX-released announcement dated 28 July 2014, which includes key Company operating metrics and performance indicators for the first half and second quarter of 2014 as well as information concerning conditions in the Company’s core markets, and reaffirms that operating and industry conditions generally remain as described in that release. The Company further notes that, as at 15 August 2014, net debt is estimated to be $555 million and drill rig utilisation is at 40%, with 380 rigs operating. In addition, order backlog in the Products business has reached a 10-month high of $23 million.

Commenting on business conditions, Richard O’Brien, President and Chief Executive Officer of Boart Longyear, stated, “As indicated in our most recent market updates, we feel we are at, or approaching, the bottom of the market. Our view could change if commodity prices for mined products fall materially from existing levels, mining companies are not successful in pushing forward planned mine expansion and development activities, or mining companies otherwise significantly cut exploration spending from current levels that are already below recent historical levels. Utilisation rates appear to have stabilised, and we expect to remain at current rates for the balance of 2014, excluding the impact of the normal year-end, holiday reduction in activity. We also anticipate, however, that pricing will continue to be a headwind throughout the balance of the year, particularly in our Drilling Services division.”

Full-year outlook

Given current and anticipated market conditions, the Company expects full-year 2014 financial performance to be consistent with current analyst consensus for revenue and EBITDA, as reflected by Bloomberg as at 15 August 2014. With a mean revenue estimate of $842 million (range of $766 million to $878 million) and a mean normalised8 EBITDA estimate of $47 million (range of $26 million to $58 million), analyst estimates reasonably conform to the Company’s current range of expectations for 2014. Similarly, consensus analyst forecasts of $531 million (range of $514 million to $561 million) for net debt at year-end also approximate Company expectations, absent the potential for additional cash charges for further restructuring activities prior to year-end.

Material uncertainty

The Company’s half-year financial statements have been prepared on the basis of a going concern, subject to certain risks outlined in Note 1 of the Half-Year Financial Report. The ability of the Company to continue as a going concern is likely to depend on the Company successfully concluding its strategic review of recapitalisation options with completion of a recapitalisation transaction no later than 30 June 2015. Without such a transaction, in order to continue as a going concern, the Company would need to either experience a significant and rapid improvement in market conditions and the financial performance of the Company or secure a future amendment to the terms of the credit agreement to provide additional head room at 30 June 2015, none of which is being assumed at present.

The Company also refers to its announcement of 18 August 2014 concerning the completion of the seventh amendment to its revolving credit facility. The amendment was completed to provide additional head room under the facility’s covenants and, therefore, offers additional assurance that the Company will continue to have access to the facility during the pendency of the strategic review. The material terms of the seventh amendment are set out in Note 13 of the Half-Year Financial Report, and complete copies of the amendment and other agreements governing the Company’s debt arrangements, such as the full revolving credit agreement, the indentures for the Company’s bonds and the Intercreditor Agreement are available on the Company’s website (www.boartlongyear.com) under the “Investors” section by selecting the “Financial/Earnings reports” tab.

Strategic review update

The Company continues to move forward on its strategic review and currently is evaluating several options that it believes will create a more sustainable capital structure and provide the resources and opportunities to enhance business enterprise value. The strategic review has explored a broad range of potential recapitalisation options, including standalone debt and equity options, a combination of the two, debt-to-equity conversions and other recapitalisation options. Discussions around such options have occurred subject to confidentiality agreements with a significant number of potential investors who have had access to the Company’s data room of confidential business and strategic information. Many of the confidentiality arrangements contain provisions requiring the Company to disclose certain material, non-public information provided to the potential investors contemporaneously with the Company’s release of its half-year financial results. The Company believes this release discloses all such information.

The Company has narrowed both the focus of the strategic review and the number of parties with whom it is, and may be, negotiating, and it is pursuing discussions around several different forms of transactions. While interest in the strategic review by potential investors remains strong, there are no assurances that negotiations will continue, that the form or terms of transactions being considered will not change or that any recapitalisation will be completed.

Mr. O’Brien stated, “Since late February, we have worked closely with our advisor, Goldman Sachs, to develop implementable recapitalisation options and, after discussions with many well-recognised and capable investors, we are optimistic we will be able to identify an effective solution to our capital structure and liquidity requirements through the ongoing strategic review. Our Board and management team continue to carefully evaluate a range of potential solutions with the best interests of our shareholders and all of our stakeholders in mind.

“Several things are clear from the feedback we have received from potential investors: the Boart Longyear franchise, which turns 125 years old next year, is fundamentally strong and valuable; we are global leaders in our services and products businesses; the cost and efficiency measures we have taken over the past 18 months position the Company for expanding margins when markets improve; and the uncertainty in the timing of a market recovery and our debt levels impacts investor perceptions of the Company’s value. As we continue work on the strategic review, we remain focused on running our business in a way that provides our clients with the industry’s highest level of service and best products and maintains mutually beneficial relationships with all of our suppliers and business partners.”

Disclaimer

This announcement contains certain “forward-looking statements.” The words “anticipate,” “believe,” “expect,” “project,” “forecast,” “estimate,” “likely,” “intend,” “should,” “could,” “may,” “target,” “plan” and other similar expressions are intended to identify forward-looking statements. Indications of, and guidance on, future earnings and financial position and performance are also forward-looking statements. Due care and attention has been used in the preparation of forecast information. Such forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors, many of which are beyond the Company’s control and may cause actual results to differ materially from those expressed or implied in such statements. There can be no assurance that actual outcomes will not differ materially from these statements.

About Boart Longyear

Approaching its 125th year anniversary in 2015, Boart Longyear is the world’s leading provider of drilling services, drilling equipment, and performance tooling for mining and drilling companies globally. It also has a substantial presence in aftermarket parts and service, energy, mine de-watering, oil sands exploration, and production drilling.

The Global Drilling Services division operates in over 40 countries for a diverse mining customer base spanning a wide range of commodities, including copper, gold, nickel, zinc, uranium, and other metals and minerals. The Global Products division designs, manufactures and sells drilling equipment, performance tooling, and aftermarket parts and services to customers in over 100 countries.

Boart Longyear is headquartered in Salt Lake City, Utah, USA, and listed on the Australian Securities Exchange in Sydney, Australia. More information about Boart Longyear can be found at www.boartlongyear.com. To get Boart Longyear news direct, visit https://www.boartlongyear.com/rssfeed.

1Adjusted EBITDA and Adjusted NPAT are non-IFRS measures and are used internally by management to assess the performance of the business and have been derived from the Company’s financial results by adding back charges relating to restructuring expenses and related impairments

2 Except for headcount, utilisation and rigs. Figures are period end, except where averages are indicated. All figures are unaudited.

3 For the trailing 12 month period. Quarterly bank compliance EBITDA was: 2Q2014 - $19.2m, 1Q2014 - $0.8m, 4Q2013 - $5.1m, 3Q2013 - $38.4m, 2Q2013 - $50.1m

4 Excludes contingent liabilities relevant to determining bank covenant compliance. See footnote #31 in the 2013 Annual Financial Report.

5 Gross maximum indebtedness covenant, inclusive of relevant contingent liabilities.

6 Includes both direct and indirect SG&A. Figures shown on page 41 of the 2013 Annual Report are for indirect SG&A only and exclude costs associated with restructuring activities.

7 Increase in Global Products employees in 2014 due to consolidation of maintenance and supply chain operations into the Global Products division in 1Q2014

8Analyst normalised EBITDA is consistent with the Company’s Adjusted EBITDA.

[column-group]

[column]

Investors:

Jay Clement

Vice President, Investor Relations/Treasury

Australia +61 (0) 8 8375 8300

USA +1 801 401 3712

ir@boartlongyear.com

[/column]

[column]

Media:

David Symons

Cato Counsel

Sydney:+61 (0) 2 8306 4244

Mobile:+61 (0) 410 559 184

david@catocounsel.com.au

[/column]

[/column-group]