Boart Longyear Announces 2014 Second Quarter and First Half Preliminary Results and Key Performance Indicators

Boart Longyear Limited (ASX: BLY), the world’s leading supplier of drilling services, drilling equipment and performance tooling for mining and drilling companies, today announces preliminary results, key performance indicators and other company information for the second quarter and half-year ended 30 June 2014. All 2014 results are preliminary and unaudited and may be subject to adjustment. These preliminary and unaudited results are stated only to the adjusted EBITDA line and do not reflect any potential asset impairments or tax adjustments, which are still under review as part of the close process and will be included in the full results release scheduled for 26 August 2014. Financial results are reported in US dollars.

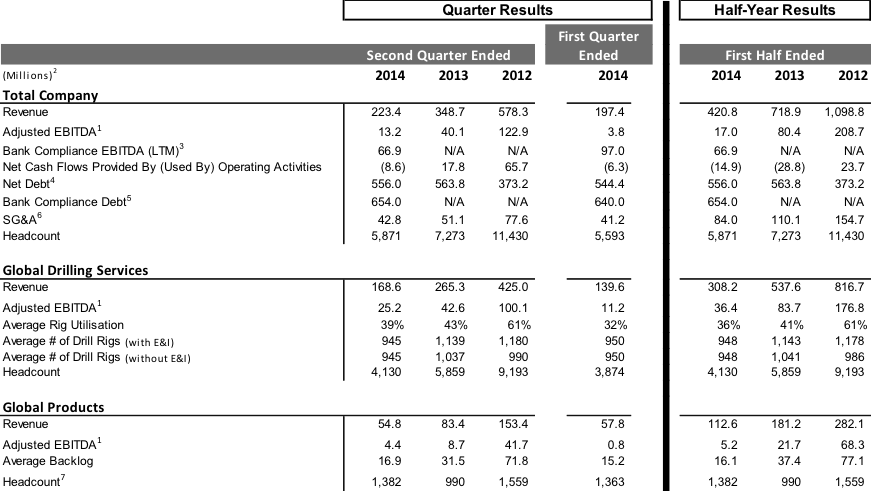

2014 second quarter preliminary financial results:

- Revenue of $224 million (2Q 2013: $349 million)

- Adjusted[1] EBITDA of $14 million (2Q 2013: $40 million)

- Net cash flows of $9 million used by operating activities (2Q 2013: net cash flows of $18 million generated)

- Covenant compliant at 30 June 2014

- Market demand stabilising but pricing pressure persists

2014 first half preliminary financial results:

- Revenue of $422 million (1H 2013: $719 million)

- Adjusted1 EBITDA of $18 million (1H 2013: $80 million)

- Net cash flows used by operating activities of $15 million (1H 2013: net cash flows used of $29 million)

Comparative information:

Business overview for second quarter shows expected seasonal uplift

Revenues and adjusted EBITDA for the total Company in the second quarter of 2014 showed a seasonal uplift from the first quarter of 2014 of 14% and 271%, respectively. Details regarding divisional performance are included below.

Drilling Services experiences continued rig underutilisation but reports robust demand in mining production and non-mining projects

Average rig utilisation in the Drilling Services division was 39% for the second quarter of 2014, improved from 32% in the first quarter of 2014 due to the normal seasonality of the business. Average rig utilisation for the second quarter was down 4 and 22 percentage points, respectively, from the corresponding quarters in 2013 and 2012. Average rig utilisation for the half-year periods ended 30 June in 2014, 2013 and 2012 were 36%, 41% and 61%, respectively, reflecting the significant reduction in mining industry exploration spending and capital investments that has occurred since mid-2012. With a substantial excess global supply of surface rigs, Drilling Services continues to experience significant price pressure. Revenues for the first half of 2014 were $308 million compared to $538 million in the first half of 2013. Adjusted EBITDA for the first half of 2014 was $37 million compared to $84 million for the same period in 2013, primarily as a result of lower utilisation and price.

During the first half of 2014 Drilling Services reported significantly improved safety performance, with a Total Case Incident Rate (TCIR) of 1.18 and Lost Time Incident Rate (LTIR) of 0.07 compared to corresponding rates of 1.65 and 0.24 for 2013. “We are committed to providing our employees and customers with an injury-free workplace and industry-leading safety performance. Steps we have taken over the past year to employ more forward-looking safety metrics and more on-the-ground interactions between our experienced supervisors and our safety-conscious employees on our rigs around the world are driving this improved performance,” said Richard O’Brien, President and Chief Executive Officer of Boart Longyear.

Although global exploration activity generally remains subdued, drilling at production-focused projects is robust. The Company’s underground coring and percussive rig fleets and water services fleet are at, or approaching, functionally full utilisation. In addition, the Company’s diversified fleet and experience across a broad range of drilling applications have resulted in several significant, non-mining drilling projects in the municipal, agricultural, and energy sectors. The Company also recently entered into a long-term agreement with a key large mining customer to secure a significant portion of work on its mine sites for several years.

Reduced product demand endures due to low rig utilisation but product development leadership continues

Revenues for the Products division were $113 million in the first half of 2014 compared to $181 million in the first half of 2013. The decrease was primarily driven by reduced customer demand related to lower global rig utilisation and customers holding lower levels of inventory. Adjusted EBITDA for Products was $6 million for the first half of 2014 compared to $22 million for the first half of 2013, largely as a result of lower sales volume. Backlog in Products was slightly higher in the second quarter than in the first quarter, and order book activity has held fairly constant from the fourth quarter of 2013. Backlog reached an 8-month high of $19.1 million at 30 June 2014.

Product development initiatives continue to progress and remain focused on hard rock tooling, drilling equipment, and incremental enhancements to existing products to drive improved safety and productivity. The Company continues to demonstrate innovative product leadership, launching a new line of down-the-hole (DTH) hammers and bits in April that increase productivity in reverse circulation (RC) drilling and conventional DTH drilling applications and can be used in almost all DTH applications, including geotechnical drilling, quarrying/mining, water well/geothermal, and mineral exploration. Development initiatives around rod-handling and automation also remain on schedule for a second half 2014 launch.

Cost efficiency measures are on track to achieve previously announced SG&A and capital reductions

As previously reported, the Company remains focused on identifying significant cost reduction opportunities in response to lower demand and increased price pressure. The Company is on track to achieve previously announced SG&A reductions of $58 million in 2014 and, therefore, still expects SG&A levels of between $165 million and $170 million for full-year 2014. In addition, the Company expects approximately $25 million of capital spending in 2014, down approximately $25 million from 2013 levels. Those reductions are in addition to reductions achieved in 2013, which removed approximately $870 million from the Company’s cost structure (cost of goods sold, SG&A and capital cost) of approximately $2.1 billion for calendar year 2012.

Business Outlook: The Boart Longyear franchise is well-positioned for improved market conditions in the future

Mr. O’Brien commented, “After successive first half declines in average utilisation rates over the last three years, we now feel we are at, or approaching, market bottom, unless commodity prices for mined products fall materially from existing levels or mining companies are not successful in pushing forward planned mine expansion or development activities. We anticipate fairly flat utilisation rates for the balance of 2014, excluding the impact of the normal year-end, holiday reduction in activity, and pricing to continue to be a headwind, particularly in our Drilling Services division.

Mr. O’Brien continued, “When our markets begin to show meaningful improvement in the future, we believe we will be able to earn better margins than the Company has experienced historically as a result of the significant reductions in SG&A and overhead costs realised in 2013 and the first half of 2014. We consider most of those cost efficiencies to be sustainable even in improved market conditions and they include the significant efficiencies we are generating through the consolidation of the Products division’s parts and services group with the Drilling Services division’s maintenance group and the supply chain groups for both divisions. In the case of improved market conditions, we also expect that, over the longer term, as our EBITDA generation improves and our improved management of inventory, working capital and capital spending is reflected in our financial performance, we will be able to pay down debt.”

Analyst estimates at the high end of the range may not reflect market conditions

Analyst estimates, as of 25 July per Bloomberg, for full-year 2014 Company revenue range from $766 million to $936 million. Full-year 2014 EBITDA estimates range from $26 million to $73 million. The Company reaffirms that it does not intend to provide guidance for half-year or full-year periods. Based on the Company’s preliminary results for the first half of 2014 and its expectations for relatively flat demand conditions and continued price pressure for the remainder of 2014, the Company believes that analyst estimates at the high end of the range currently may not fully reflect market conditions for demand and, in particular, the price pressure currently facing the exploration drilling services industry.

Cash flows and liquidity

For the first half of 2014 the Company generated $16 million of cash from operations (including a $22 million reduction in inventory offset by other changes in net assets and liabilities), invested a net $7 million in the business and utilised $37 million of financing related cash flows. Including net interest and tax payments, net cash flows used in operating activities were $15 million. As a result, gross debt increased from $585 million at 31 December 2013 to $624 million at 30 June 2014 while net debt increased from $544 million to $556 million during the same period. Debt balances rose largely as a result of $26 million of senior note interest payments made in April and to seasonal liquidity requirements. At 30 June 2014, the Company maintained $91 million of available capacity under its bank credit facility in addition to cash on hand of $68 million.

The Company was compliant with all of its bank financial covenants at 30 June 2014. The Company expects that it will remain covenant compliant at least through the end of 2014, which should allow adequate time for the Company to identify and implement a recapitalisation solution as a result of the ongoing strategic review. The Company, however, notes the volatility of its markets and that its covenant compliance forecasts are based on certain assumptions, including as to market demand, pricing and geo-political conditions, which, if not realised, present material risks as to the accuracy of the Company’s forecasts and the Company’s ability to comply prospectively with its covenants. The terms of the Company’s secured and unsecured bonds do not contain financial maintenance covenants that could impact access to the bank revolver facility and trigger the accumulation of the acceleration of the maturities for those bonds absent a default under the bank revolver terms or failure to pay interest under the bonds when due.

Mr. O’Brien commented, “Our underlying franchise remains strong. We expect to have the liquidity and financial resources necessary to fund our operations for the foreseeable future, including supporting our customers’ needs and meeting our obligations to our suppliers and other creditors, and we are confident we will be able to identify an effective solution to our capital structure through the ongoing strategic review. We remain committed to providing our clients with the industry’s highest level of service and best products and to have mutually beneficial relationships with all of our suppliers and business partners, as we have in the past.”

The strategic review continues

As announced in February, the Company is conducting a strategic review of recapitalisation options with a goal of putting in place a more sustainable capital structure to ultimately enhance shareholder value and ensure the financial viability of the Company. Goldman Sachs is advising the Company, and Greenhill is providing independent advice to the Company’s Board of Directors during this process. The Company has, as mentioned in previous press releases, also employed other advisors and law firms throughout the pendency of the strategic review to provide specialised assistance. The Board and its Finance Committee have met on a regular and frequent basis to ensure that the Board monitors ongoing liquidity and business performance and provides robust and engaged leadership during the strategic review process to ensure of the full range of options available to the Company are fully evaluated and the interests of all stakeholders are properly considered and balanced in the best interests of the Company. The Company continues to evaluate a number of capital options that it considers will provide the liquidity necessary to support the business and provide the opportunity to enhance business enterprise value.

The Company will communicate material developments regarding the strategic review in a timely manner. In addition, it expects to announce its final half-year results on Tuesday, 26 August 2014 in Sydney.

Disclaimer

This announcement contains certain “forward-looking statements.” The words “anticipate,” “believe,” “expect,” “project,” “forecast,” “estimate,” “likely,” “intend,” “should,” “could,” “may,” “target,” “plan” and other similar expressions are intended to identify forward-looking statements. Indications of, and guidance on, future earnings and financial position and performance are also forward-looking statements. Due care and attention has been used in the preparation of forecast information. Such forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors, many of which are beyond the Company’s control and may cause actual results to differ materially from those expressed or implied in such statements. There can be no assurance that actual outcomes will not differ materially from these statements.

About Boart Longyear

With over 120 years of expertise, Boart Longyear is the world’s leading provider of drilling services, drilling equipment, and performance tooling for mining and drilling companies globally. It also has a substantial presence in aftermarket parts and service, energy, mine de-watering, oil sands exploration, and production drilling.

The Global Drilling Services division operates in over 40 countries for a diverse mining customer base spanning a wide range of commodities, including copper, gold, nickel, zinc, uranium, and other metals and minerals. The Global Products division designs, manufactures and sells drilling equipment, performance tooling, and aftermarket parts and services to customers in over 100 countries.

Boart Longyear is headquartered in Salt Lake City, Utah, USA, and listed on the Australian Securities Exchange in Sydney, Australia. More information about Boart Longyear can be found at www.boartlongyear.com. To get Boart Longyear news direct, visit https://www.boartlongyear.com/rssfeed.

Investor Relations

[column-group]

[column]

Investor Relations

Jay Clement

Vice President, Investor Relations/Treasury

Australia 08 8375 8300

USA +1 801 401 3712

ir@boartlongyear.com

[/column]

[column]

Media:

David Symons

Cato Counsel

Sydney: (02) 9212 4666

Mobile: 410 559 184

david@catocounsel.com.au

[/column]

[/column-group]

[1]Adjusted EBITDA is a non-IFRS measure and is used internally by management to assess the performance of the business and has been derived from the Company’s financial results by adding back charges relating to restructuring and impairments

2 Except headcount, utilisation and rigs. Figures are period end, except where averages are indicated. All figures are unaudited.

3 For the trailing 12 month period. Quarterly bank compliance EBITDA was: 2Q2014 - $21.4m, 1Q2014 - $2.5m, 4Q2013 - $5.3m, 3Q2013 - $38.6m, 2Q2013 - $50.1m

4 Excludes contingent liabilities relevant to determining bank covenant compliance. See footnote #31 in Annual Financial Report.

5 Gross maximum indebtedness covenant, inclusive of relevant contingent liabilities.

6 Includes both direct and indirect SG&A. Figures shown on page 41 of the 2013 Annual Report are for indirect SG&A only and exclude costs associated with restructuring activities.

7 Increase in Global Products employees in 2014 due to consolidation of maintenance and supply chain operations into the Global Products division in 1Q2014